Leaderlessness

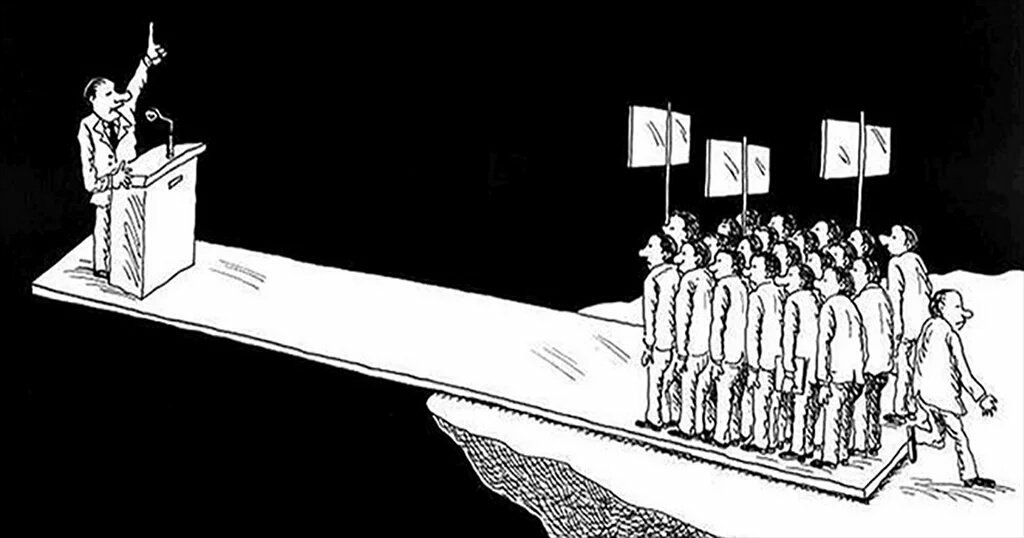

Top-down power structures make sense, and have their advantages. But what of leaderless systems?

Pick any ten cryptocurrencies. In that ten, nine will have a de facto central authority or leader-entity with the power to make the important decisions. If Bitcoin wasn’t included in the list, ten will.

There are advantages to having an authority in a given governance or power construct. A leader or central coordinator can often make things more efficient in more than one way. A leader can be decisive, and a leader-governed system can commit itself wholly towards one singular focus or pursuit. A leader can be a powerful catalyst for mobilization, and, in certain senses and contexts, a system with a central controller can be flexible and adaptable in ways that a convergent-but-leaderless system cannot.

With no central authority, things are messy. In semantic disputes, there’s no privileged arbiter to turn to. Governance structures are rarely (if ever) explicitly codified, and the respective power and influence of different parties, entities, or factions is often in complicated and dynamic conflict. It’s an ugly, often almost-indecipherable state of affairs, where every question seems to expand fractally before you as you pour more and more attention and thought into it.

Who controls Bitcoin?

For the first two years after Bitcoin launched, it would be fair to say that Satoshi Nakamoto had enough influence and power over the project to be able to unilaterally “call the shots” in emergency situations. Such was the (well-earned) respect of Nakamoto, that if any contentious split arose, and Satoshi backed one side of it, it would be virtually guaranteed to “win” the war, in the end.

But Satoshi left. If “The greatest trick the Devil ever pulled was convincing the world he didn’t exist” then “The greatest trick Satoshi ever pulled was disappearing”. It’s debatable whether the same stunt could ever be executed in quite the same way again. This is an indispensable and irreplicable component of Bitcoin’s “Immaculate Conception” origin story, and one of many properties that sets it apart from the coins and projects which have appeared in its wake.

After Satoshi vanished, Bitcoin was left without any clear leader or dictator. In fact, it is perhaps the only project of its profile or degree of significance that boasts this property, as Mike Hearn infamously (and ironically) criticized as unworkable. While a select group of contributors had direct commit-access to the GitHub repository where the reference implementation was hosted and this does have clout, other stakeholders in the ecosystem, like exchanges (e.g. Coinbase, Binance, Bitstamp, and Bitfinex) or mining operations (e.g. Bitmain, F2Pool, and BitFury) have a meaningful say when it comes to the future of Bitcoin.

But one of the most incredible and special properties of Bitcoin is the sovereignty it affords to the end-user directly. An uncompromising priority of and emphasis on this property has become part of the Bitcoin ethos, in a way that doesn’t seem imitated in any other cryptocurrency network. The CONOP has been ruthlessly minimized and the ability to self-validate has been passionately and consistently defended, the result being that a nontrivial amount of power and influence in Bitcoin is retained in the hands of “the people” that run it.